|

| BSE Sensex : 32 months ago and today (Source: Google Finance) |

The Sensex on Tuesday just barely crossed the 20,000 mark to close at 20001.55 and its fellow benchmark index Nifty closed at 6009.05. There is something very different about the 20,000 mark. It is a limiting psychological barrier, especially since the last time the Sensex crossed it was followed by its worst fall in history (see chart). The stock markets have become a prominent discussion; especially with some people who become over enthusiastic and share anecdotes of their previous heroic encounters of riding the Bull Run . Some are still recovering from the last of the bear claws, and there are most importantly others who are confused and yet obdurate of investing in the markets. For they know if they can pull this one off, it will be remembered by one and all.

The whole dilemma surrounds the principle notion of “this time is different”. But is it really so? Can we be sure that the crash from the peak of 20,000 in 2008, about 32 months ago will not happen again. Can the market pundits on the TV quell our fears about the market, and encourage us to make a quick buck before Diwali? Well nobody can predict the right answers, but we at least have to acknowledge that time is not constant, and whatever the present conditions, this time will never be different.

|

| Source : NSE |

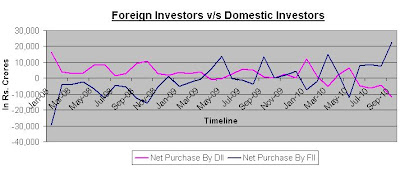

The first question, then, is to ask who paid for this ride? FIIs have put in record amounts of money in the stock market this year. The above chart I have assembled shows how currently FII have been strong resilient net buyers and domestic investors are selling their investments. The domestic investors are probably not confident of the market so much and definitely when the Sensex is in the 18,500+ range.

Indian markets are a good bet for foreign investors for whom the lack of good investment opportunities in the West is making them look East. There are still some worries about the debt-laden Euro nations. The recovery in America

This leads to my second question, so how long will the Sensex hover above the 20,000 level? Well there is a slight idea that it could be as long as the foreign investors want to stay put in the Indian markets, which implies as long as no other attractive investment opportunities emerge elsewhere outside India

Again all this depends on the markets perception of the fundamentals of the stocks. India

|

| Source: Stockezy.com |

Coming to the last and most important question that is this the right time to invest in the markets? If you were till now expecting a clear answer from me, I am sorry to disappoint you. I am still not convinced about the reasons to be bullish or bearish, and I am not the only one. Well that’s also what the market has been thinking in the last couple of weeks. Have look at the NSE VIX, which measures on the basis of existing options contracts, the market’s expectations in the coming days or months. High volatility in recent weeks shows how investors are currently viewing the market’s situation.

To sum it up, the market can be judged to thriving on exuberance and optimism, whether it is rational or irrational, only time will tell. I think it will be prudent and wise for me to sit out of this fight and leave it for the biggies to clean up. Will you too?